The Double Tax Deduction for Internationalisation (DTDI) is a tax incentive program established by the Singapore government to encourage companies to expand their business abroad. Taking advantage of this allows the company to claim 200% tax deductions on eligible expenses.

Companies must qualify for particular criteria:

• A resident or citizen of Singapore with an income tax number

• Tracked and invoiced international business expansion activities within two years of the income tax return year

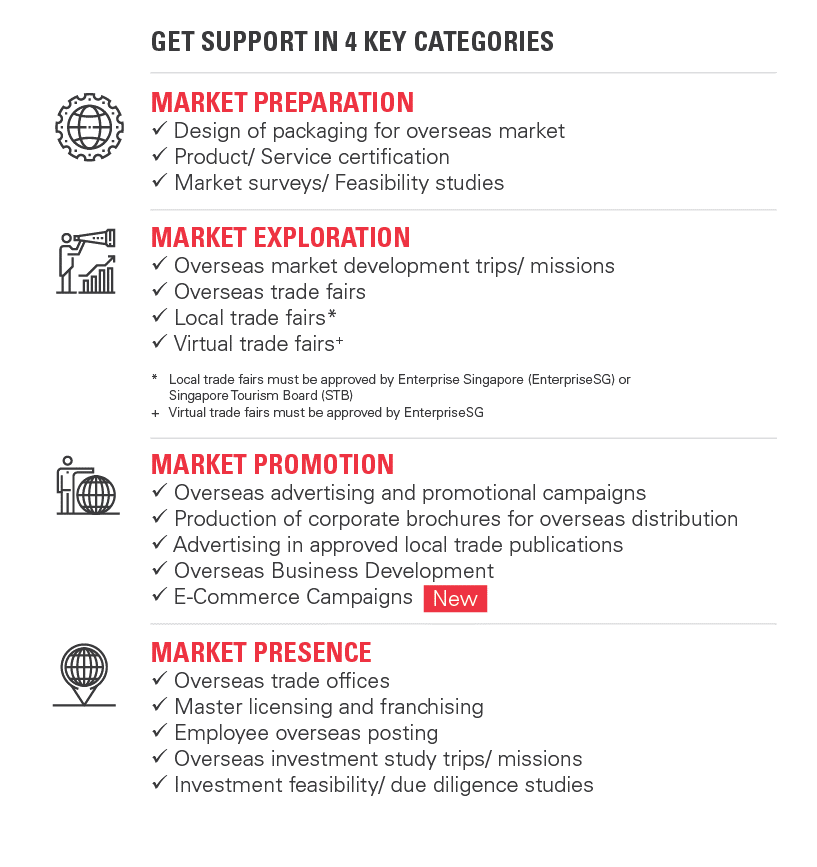

• Qualifying expenses in the four key categories or market preparation, market exploration, marketing promotion & advertising and market presence.

What you need:

• DTDI (Double Tax Deduction for Internationalisation) application form

• Submit application with Corppass for activities

• Evaluation form from EnterpriseSG

• Log of invoices and receipts for activity expenses

Apply online at https://www.enterprisesg.gov.sg/financial-support/double-tax-deduction-for-internationalisation

More information:

https://www.imda.gov.sg/disg/Programmes/2019/04/double-tax-deduction-for-internationalisation